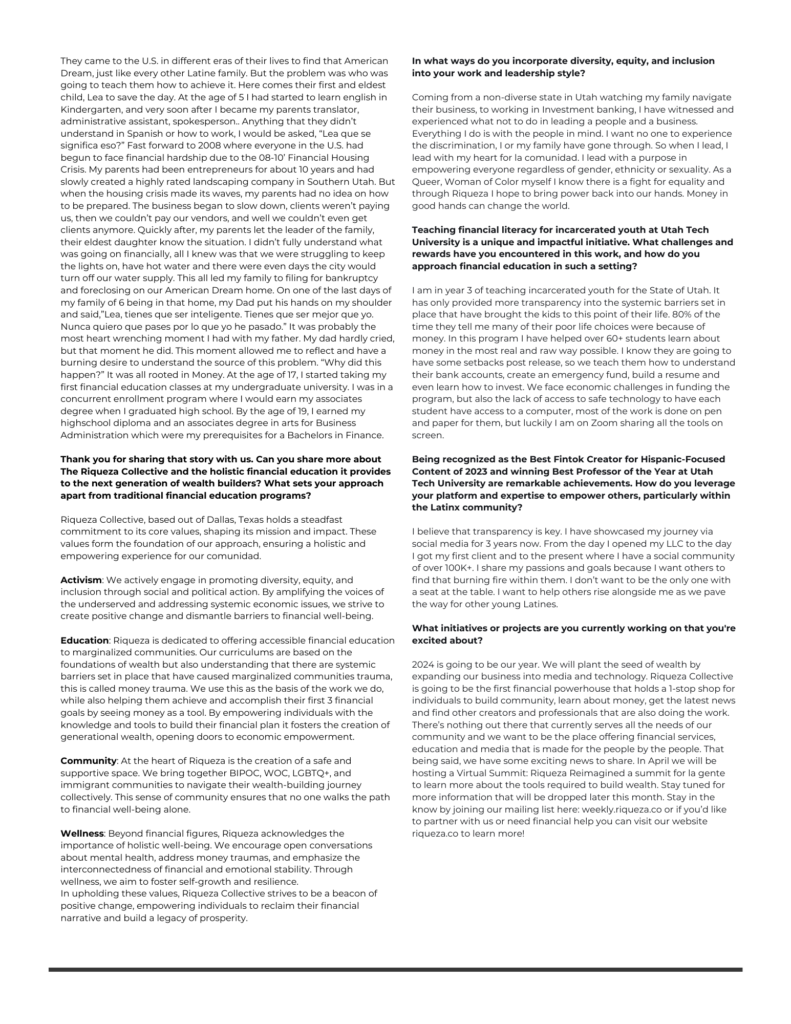

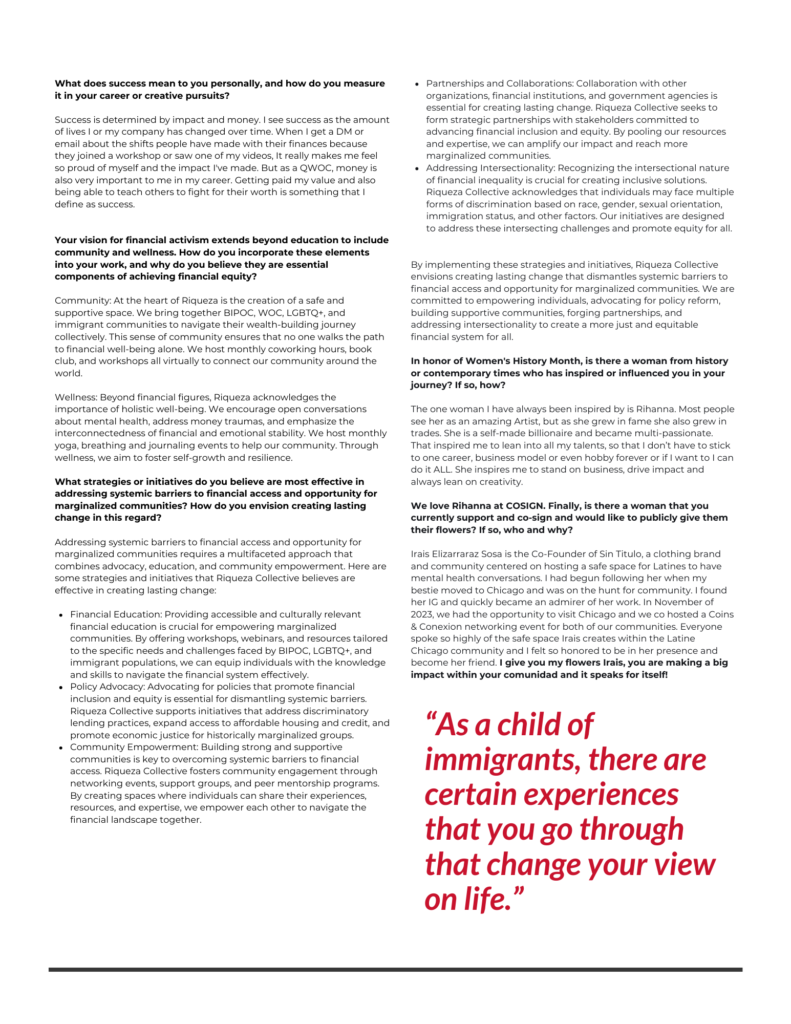

Lea Landaverde: The Riqueza Collective 2024 Woman To Watch

Welcome to an exclusive Q&A with Lea Landaverde, affectionately known as the Latina Wealth Activist, a trailblazing financial professional and visionary creator. Hailing from Dallas, Texas, Lea is a Queer, First-Gen Latina on a mission to revolutionize financial education and empowerment. As the Founder of The Riqueza Collective, she leads a holistic financial powerhouse dedicated to providing bilingual financial education to the next generation of wealth builders. Armed with a Master’s degree in Finance from the University of Utah and certified as a practitioner of the Trauma of Money, Lea brings over 9 years of experience in wealth management, investment banking, technology, and personal finance to her mission. With a remarkable online presence boasting over 100k followers and accolades such as the Best Fintok Creator for Hispanic-Focused Content of 2023 from Debt.com, Lea’s impact transcends digital platforms.

Her commitment to financial equity is further underscored by her recognition as the Best Professor of the Year for 2021 at Utah Tech University, where she teaches financial literacy to incarcerated youth. Join us as we delve into Lea’s journey, insights, and unwavering dedication to bridging the wealth gap and advocating for financial equity in marginalized communities through activism, education, community, and wellness.

Lea, thank you for chatting with us. As the Latina Wealth Activist, you’re dedicated to bridging the wealth gap and advocating for financial equity in marginalized communities. What inspired you to embark on this mission, and how has your personal journey influenced your approach to financial education?

As a child of immigrants, there are certain experiences that you go through that change your view on life. See, my parents are from El Salvador and didn’t even study past 8th grade due to the need of providing for their familia.

They came to the U.S. in different eras of their lives to find that American Dream, just like every other Latine family. But the problem was who was going to teach them how to achieve it. Here comes their first and eldest child, Lea to save the day. At the age of 5 I had started to learn english in Kindergarten, and very soon after I became my parents translator, administrative assistant, spokesperson.. Anything that they didn’t understand in Spanish or how to work, I would be asked, “Lea que se significa eso?” Fast forward to 2008 where everyone in the U.S. had begun to face financial hardship due to the 08-10’ Financial Housing Crisis. My parents had been entrepreneurs for about 10 years and had slowly created a highly rated landscaping company in Southern Utah. But when the housing crisis made its waves, my parents had no idea on how to be prepared. The business began to slow down, clients weren’t paying us, then we couldn’t pay our vendors, and well we couldn’t even get clients anymore. Quickly after, my parents let the leader of the family, their eldest daughter know the situation. I didn’t fully understand what was going on financially, all I knew was that we were struggling to keep the lights on, have hot water and there were even days the city would turn off our water supply. This all led my family to filing for bankruptcy and foreclosing on our American Dream home. On one of the last days of my family of 6 being in that home, my Dad put his hands on my shoulder and said,”Lea, tienes que ser inteligente. Tienes que ser mejor que yo. Nunca quiero que pases por lo que yo he pasado.” It was probably the most heart wrenching moment I had with my father. My dad hardly cried, but that moment he did. This moment allowed me to reflect and have a burning desire to understand the source of this problem. “Why did this happen?” It was all rooted in Money. At the age of 17, I started taking my first financial education classes at my undergraduate university. I was in a concurrent enrollment program where I would earn my associates degree when I graduated high school. By the age of 19, I earned my highschool diploma and an associates degree in arts for Business Administration which were my prerequisites for a Bachelors in Finance.

Thank you for sharing that story with us. Can you share more about The Riqueza Collective and the holistic financial education it provides to the next generation of wealth builders? What sets your approach apart from traditional financial education programs?

Riqueza Collective, based out of Dallas, Texas holds a steadfast commitment to its core values, shaping its mission and impact. These values form the foundation of our approach, ensuring a holistic and empowering experience for our comunidad. Activism: We actively engage in promoting diversity, equity, and inclusion through social and political action. By amplifying the voices of the underserved and addressing systemic economic issues, we strive to create positive change and dismantle barriers to financial well-being. Education: Riqueza is dedicated to offering accessible financial education to marginalized communities. Our curriculums are based on the foundations of wealth but also understanding that there are systemic barriers set in place that have caused marginalized communities trauma, this is called money trauma. We use this as the basis of the work we do, while also helping them achieve and accomplish their first 3 financial goals by seeing money as a tool. By empowering individuals with the knowledge and tools to build their financial plan it fosters the creation of generational wealth, opening doors to economic empowerment. Community: At the heart of Riqueza is the creation of a safe and supportive space. We bring together BIPOC, WOC, LGBTQ+, and immigrant communities to navigate their wealth-building journey collectively. This sense of community ensures that no one walks the path to financial well-being alone. Wellness: Beyond financial figures, Riqueza acknowledges the importance of holistic well-being. We encourage open conversations about mental health, address money traumas, and emphasize the interconnectedness of financial and emotional stability. Through wellness, we aim to foster self-growth and resilience. In upholding these values, Riqueza Collective strives to be a beacon of positive change, empowering individuals to reclaim their financial narrative and build a legacy of prosperity.

In what ways do you incorporate diversity, equity, and inclusion into your work and leadership style?

Coming from a non-diverse state in Utah watching my family navigate their business, to working in Investment banking, I have witnessed and experienced what not to do in leading a people and a business. Everything I do is with the people in mind. I want no one to experience the discrimination, I or my family have gone through. So when I lead, I lead with my heart for la comunidad. I lead with a purpose in empowering everyone regardless of gender, ethnicity or sexuality. As a Queer, Woman of Color myself I know there is a fight for equality and through Riqueza I hope to bring power back into our hands. Money in good hands can change the world.

Teaching financial literacy for incarcerated youth at Utah Tech University is a unique and impactful initiative. What challenges and rewards have you encountered in this work, and how do you approach financial education in such a setting?

I am in year 3 of teaching incarcerated youth for the State of Utah. It has only provided more transparency into the systemic barriers set in place that have brought the kids to this point of their life. 80% of the time they tell me many of their poor life choices were because of money. In this program I have helped over 60+ students learn about money in the most real and raw way possible. I know they are going to have some setbacks post release, so we teach them how to understand their bank accounts, create an emergency fund, build a resume and even learn how to invest. We face economic challenges in funding the program, but also the lack of access to safe technology to have each student have access to a computer, most of the work is done on pen and paper for them, but luckily I am on Zoom sharing all the tools on screen.

Being recognized as the Best Fintok Creator for Hispanic-Focused Content of 2023 and winning Best Professor of the Year at Utah Tech University are remarkable achievements. How do you leverage your platform and expertise to empower others, particularly within the Latinx community?

I believe that transparency is key. I have showcased my journey via social media for 3 years now. From the day I opened my LLC to the day I got my first client and to the present where I have a social community of over 100K+. I share my passions and goals because I want others to find that burning fire within them. I don’t want to be the only one with a seat at the table. I want to help others rise alongside me as we pave the way for other young Latines.

What initiatives or projects are you currently working on that you’re excited about?

2024 is going to be our year. We will plant the seed of wealth by expanding our business into media and technology. Riqueza Collective is going to be the first financial powerhouse that holds a 1-stop shop for individuals to build community, learn about money, get the latest news and find other creators and professionals that are also doing the work. There’s nothing out there that currently serves all the needs of our community and we want to be the place offering financial services, education and media that is made for the people by the people. That being said, we have some exciting news to share. In April we will be hosting a Virtual Summit: Riqueza Reimagined a summit for la gente to learn more about the tools required to build wealth. Stay tuned for more information that will be dropped later this month. Stay in the know by joining our mailing list here: weekly.riqueza.co or if you’d like to partner with us or need financial help you can visit our website riqueza.co to learn more!

What does success mean to you personally, and how do you measure it in your career or creative pursuits?

Success is determined by impact and money. I see success as the amount of lives I or my company has changed over time. When I get a DM or email about the shifts people have made with their finances because they joined a workshop or saw one of my videos, It really makes me feel so proud of myself and the impact I’ve made. But as a QWOC, money is also very important to me in my career. Getting paid my value and also being able to teach others to fight for their worth is something that I define as success.

Your vision for financial activism extends beyond education to include community and wellness. How do you incorporate these elements into your work, and why do you believe they are essential components of achieving financial equity?

Community: At the heart of Riqueza is the creation of a safe and supportive space. We bring together BIPOC, WOC, LGBTQ+, and immigrant communities to navigate their wealth-building journey collectively. This sense of community ensures that no one walks the path to financial well-being alone. We host monthly coworking hours, book club, and workshops all virtually to connect our community around the world.

Wellness: Beyond financial figures, Riqueza acknowledges the importance of holistic well-being. We encourage open conversations about mental health, address money traumas, and emphasize the interconnectedness of financial and emotional stability. We host monthly yoga, breathing and journaling events to help our community. Through wellness, we aim to foster self-growth and resilience.

What strategies or initiatives do you believe are most effective in addressing systemic barriers to financial access and opportunity for marginalized communities?

How do you envision creating lasting change in this regard? Addressing systemic barriers to financial access and opportunity for marginalized communities requires a multifaceted approach that combines advocacy, education, and community empowerment. Here are some strategies and initiatives that Riqueza Collective believes are effective in creating lasting change:

- Financial Education: Providing accessible and culturally relevant financial education is crucial for empowering marginalized communities. By offering workshops, webinars, and resources tailored to the specific needs and challenges faced by BIPOC, LGBTQ+, and immigrant populations, we can equip individuals with the knowledge and skills to navigate the financial system effectively.

- Policy Advocacy: Advocating for policies that promote financial inclusion and equity is essential for dismantling systemic barriers. Riqueza Collective supports initiatives that address discriminatory lending practices, expand access to affordable housing and credit, and promote economic justice for historically marginalized groups.

- Community Empowerment: Building strong and supportive communities is key to overcoming systemic barriers to financial access. Riqueza Collective fosters community engagement through networking events, support groups, and peer mentorship programs. By creating spaces where individuals can share their experiences, resources, and expertise, we empower each other to navigate the financial landscape together.

Partnerships and Collaborations: Collaboration with other organizations, financial institutions, and government agencies is essential for creating lasting change. Riqueza Collective seeks to form strategic partnerships with stakeholders committed to advancing financial inclusion and equity. By pooling our resources and expertise, we can amplify our impact and reach more marginalized communities.

- Addressing Intersectionality: Recognizing the intersectional nature of financial inequality is crucial for creating inclusive solutions. Riqueza Collective acknowledges that individuals may face multiple forms of discrimination based on race, gender, sexual orientation, immigration status, and other factors. Our initiatives are designed to address these intersecting challenges and promote equity for all.

By implementing these strategies and initiatives, Riqueza Collective envisions creating lasting change that dismantles systemic barriers to financial access and opportunity for marginalized communities. We are committed to empowering individuals, advocating for policy reform, building supportive communities, forging partnerships, and addressing intersectionality to create a more just and equitable financial system for all.

In honor of Women’s History Month, is there a woman from history or contemporary times who has inspired or influenced you in your journey? If so, how?

The one woman I have always been inspired by is Rihanna. Most people see her as an amazing Artist, but as she grew in fame she also grew in trades. She is a self-made billionaire and became multi-passionate. That inspired me to lean into all my talents, so that I don’t have to stick to one career, business model or even hobby forever or if I want to I can do it ALL. She inspires me to stand on business, drive impact and always lean on creativity.

We love Rihanna at COSIGN. Finally, is there a woman that you currently support and co-sign and would like to publicly give them their flowers? If so, who and why?

Irais Elizarraraz Sosa is the Co-Founder of Sin Titulo, a clothing brand and community centered on hosting a safe space for Latines to have mental health conversations. I had begun following her when my bestie moved to Chicago and was on the hunt for community. I found her IG and quickly became an admirer of her work. In November of 2023, we had the opportunity to visit Chicago and we co hosted a Coins & Conexion networking event for both of our communities. Everyone spoke so highly of the safe space Irais creates within the Latine Chicago community and I felt so honored to be in her presence and become her friend. I give you my flowers Irais, you are making a big impact within your comunidad and it speaks for itself!