RELATIONSHIPS WITH MONEY

Maximize your funds in our 4-week

small business interactive program with panels and workshops.

Are you a new, current, existing, or aspiring entrepreneur looking to gain information on business finances, taxes, credit, building generational wealth, and the confidence to walk into a bank prepared to receive a business loan or line of credit? Then, this cohort is for you.

Join us for our “Relationships With Money” cohort in partnership with Frost Bank. Local leading financial experts as well as Frost Bank personnel will walk us through what it takes to understand and effectively use various financial skills to set our business up for success.

“Relationships With Money,” is a transformative 4-week program designed exclusively for small business owners and entrepreneurs committed to building bankable businesses. This program will also be coupled with two social networking mixers to help entrepreneurs build their network along with a post wellness event for entrepreneurs to decompress and practice mindfulness. This comprehensive program aims to empower you with the financial knowledge and tools needed to navigate the complex landscape of business finance successfully.

April 2 – Relationships With Money cohort mixer: Meet the speakers, mentors, partners, team, and participants

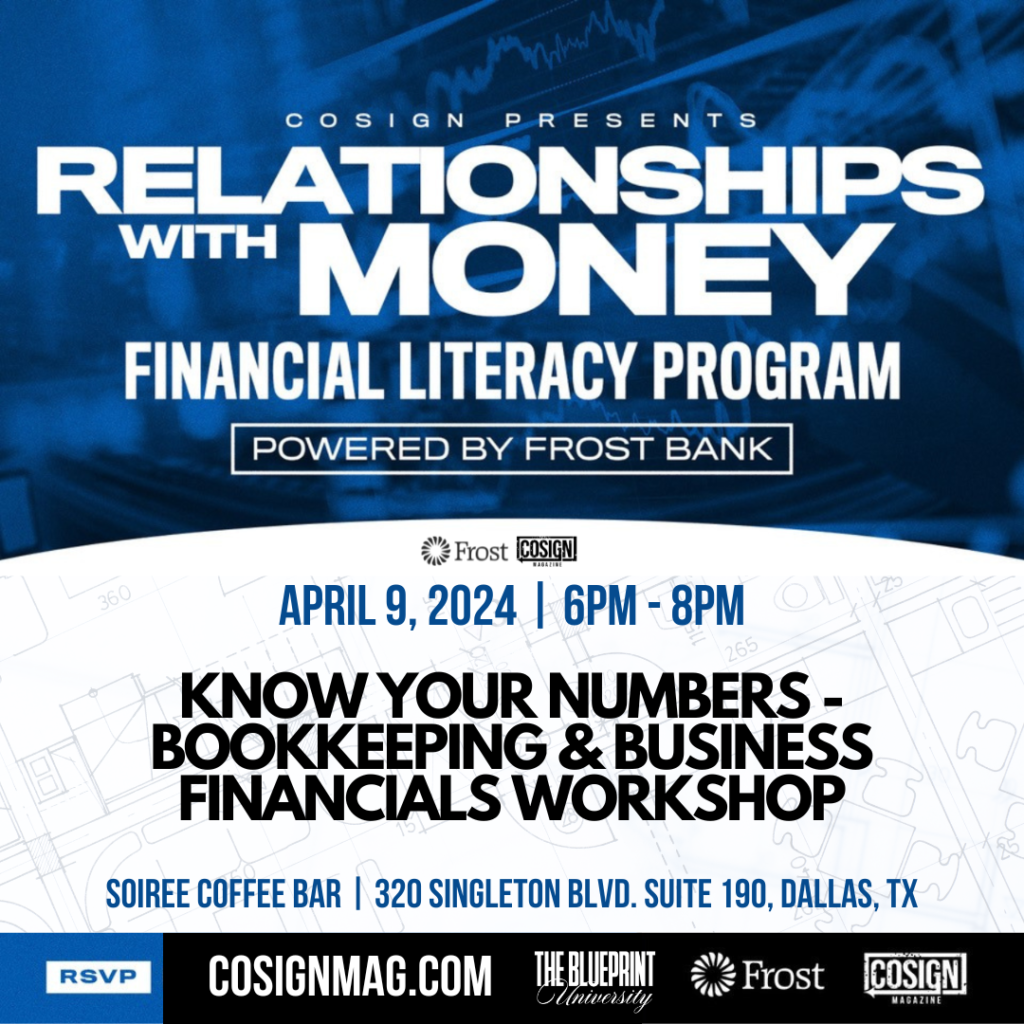

April 9 Week 1: Know Your Numbers – Bookkeeping & Business Financials Workshop

Get ready to master the art of financial organization and management. In our first week, we’ll delve into a hands-on bookkeeping workshop. Learn the fundamentals of maintaining accurate records, creating financial statements, and understanding the pulse of your business through numbers. By the end of this week, you’ll have the skills to keep your financial house in order.

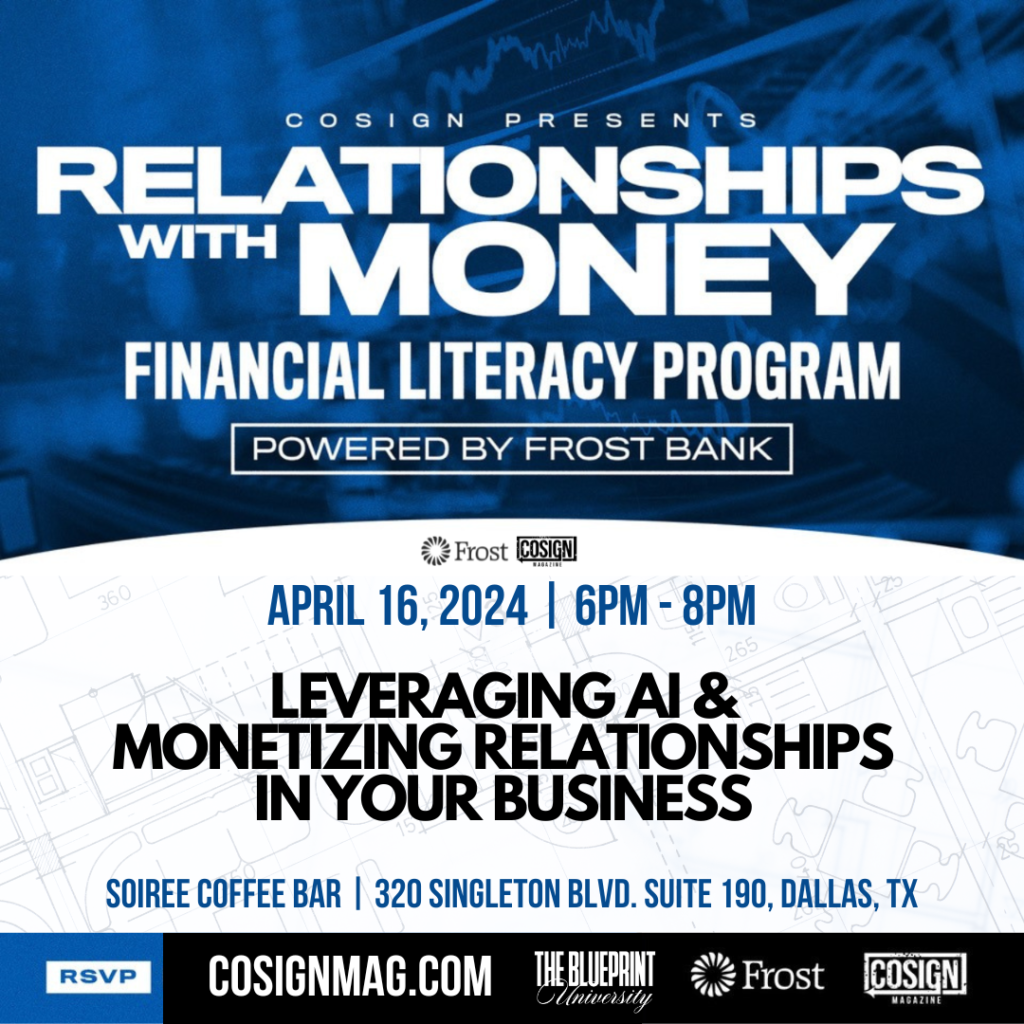

April 16 Week 2: Leveraging AI & Monetizing Relationships in Your Business

In the digital age, harnessing the power of artificial intelligence is essential. Discover how AI can revolutionize your business operations, from automating routine tasks to gaining valuable insights into your financial data. Our experts will guide you through practical applications, ensuring you leave equipped to leverage AI for increased efficiency and informed decision-making.

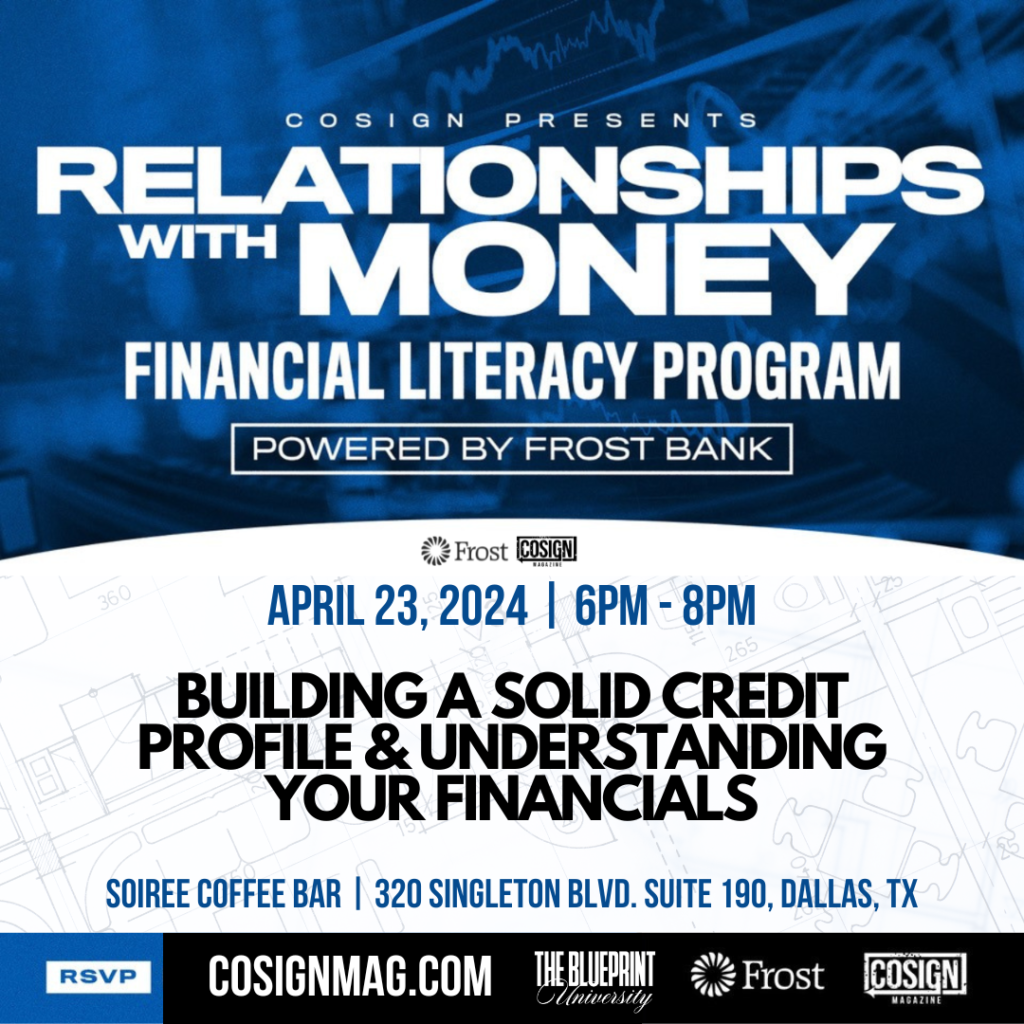

April 23 Week 3: Building a Solid Credit Profile & Understanding Your Financials

Unlock the secrets to establishing and maintaining a strong credit profile for your business. Week three is dedicated to navigating the financial landscape and understanding how a solid credit history can open doors to funding and growth opportunities. Learn strategies to enhance your creditworthiness and position your business for success when dealing with banks and financial institutions.

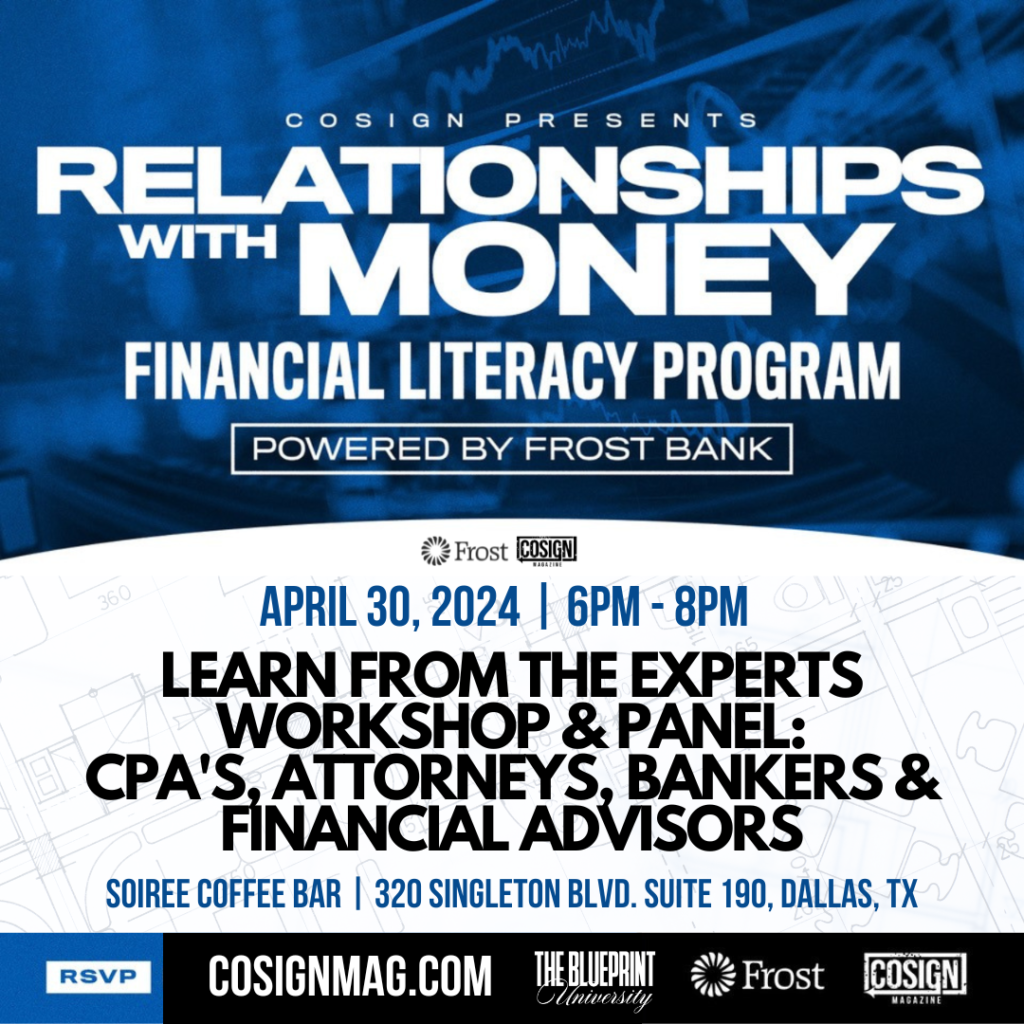

April 30 Week 4: Learn from the Experts – CPA’s, Attorneys, & Financial Advisors

Our final week brings you face-to-face with industry experts. Engage in insightful discussions with certified public accountants (CPA’s), seasoned attorneys, and successful serial entrepreneurs. Gain practical advice, learn from real-world experiences, and ask your burning questions to a panel of professionals who have navigated the challenges and triumphs of entrepreneurship.

Pitch for a chance to win capital for your business! $$$

Location: